Metals in Electric Vehicles Battery Market Trends and Analysis by Metal Type, Battery Type, Application and Segment Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

- Understand the current and future market conditions, allowing businesses to make informed decisions about market entry, product development, and investments

- Access the capabilities of competitors to maintain a competitive edge in the market

- Identify various segments and understand the different stakeholders involved at different stages of the entire value chain

- Predict shifts in market demand and tailor business development strategies accordingly

- Determine potential regions and countries that offer growth opportunities

How is our ‘Metals in EV Battery’ report different from other reports in the market?

- The report offers an in-depth analysis of the market size and forecasts for more than 12 countries, measured in volume (million tonnes). It covers historical and projected data from 2020 to 2030.

- The report includes comprehensive segmentation by metal type including lithium, nickel, cobalt, manganese, aluminum, and others, and is segmented by battery type including lithium-ion (Li-ion) battery, nickel-metal hydride battery, and others. In addition, it offers segmentation by application including personal vehicles and commercial vehicles.

- The report provides a detailed examination of the value chain, regulatory trends, battery metal recycling trends, technological trends, and a list of ongoing projects in the market across the metals in the EV battery market.

- The study highlights crucial factors influencing the market dynamics of the metals in the EV battery market space. It features market drivers, challenges, and opportunities under industry trend analysis.

- The competitive landscape section features heat-map analysis, and mergers & acquisitions (M&A) across the metals in EV battery equipment types.

- The report includes extensive company profiles for major market vendors, focusing on business overview, financial performance, SWOT analysis, key personnel, and strategic initiatives.

We recommend this valuable source of information to:

- Mining/Metals/EV Battery/Electric Vehicle Companies

- Mining Ore and EV Battery Suppliers

- Contract Manufacturers

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Metals in the EV Battery Market, Download a Free Report Sample

Metals in EV Battery Market Report Overview

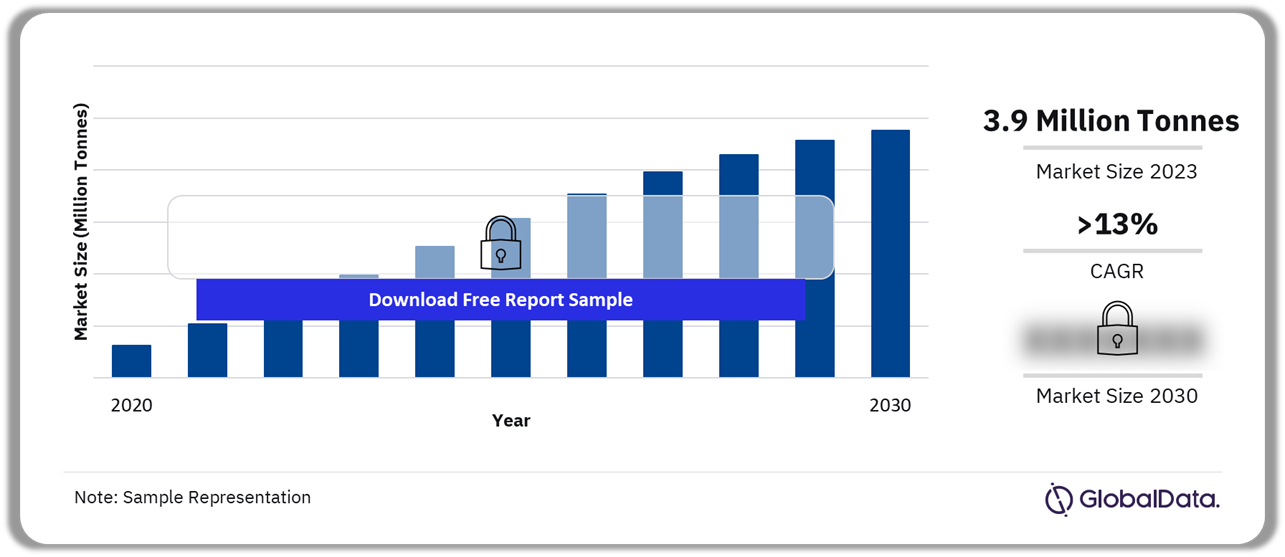

The metals in EV battery market size was estimated at 3.9 million tonnes in terms of volume in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 13% over the forecast period. The rising focus of consumers toward sustainable alternatives to traditional combustion engines is driving demand for electric vehicles (EVs) and their allied components, including batteries, across the automotive sector.

The increasing production of electric vehicles is boosting demand for metals used in their batteries comprising lithium-ion (li-ion) and nickel-metal hydride batteries. According to the International Energy Agency (IEA), in 2023, electric car sales reached almost 14 million, at a year-on-year growth of 35%. As per the agency’s estimates, global electric car sales are set to reach around 17 million by the end of 2024. The rising governmental support for the use of electric vehicles is expected to provide further momentum to the growth of EVs over the forecast period.

Metals in EV Battery Market Outlook, 2020–2030 (Million Tonnes)

Buy the Full Report for Additional Insights on the Metals in EV Battery Market Forecast

The metals in the EV battery market are anticipated to experience more than double-digit growth over the estimated period. This will be supported by the development of metals mining infrastructure through new investments. The rising focus on the importance of recycling infrastructure for the metals used in EV batteries is further projected to support the market growth. This will also aid in environmentally friendly production and manufacturing of EV batteries, aligning with companies’ and governments’ sustainability objectives.

In Oct 2023, American Battery Technology Company (ABTC), based in Reno, Nevada, started operations at its lithium-ion battery (LIB) recycling facility located in the Tahoe-Reno Industrial Center (TRIC) in McCarran. The company has finalized the acquisition of this fully equipped commercial-scale battery recycling facility in March 2023, as a part of a strategic move to enable ABTC to expand its operations and develop its lithium-ion battery (LIB) recycling technologies.

Emerging markets such as India, Vietnam, and Thailand are anticipated to witness noticeable growth over the estimated timeframe. However, to meet this high demand, the lack of adequate EV charging infrastructure poses a challenge for EV companies. The transportation industry in emerging economies is still in the initial phase of electrification, which may limit the widespread adoption of electric vehicles if not effectively addressed by the market participants.

| Market Size (2023) | 127.0 million tonnes |

| CAGR (2023 – 2030) | >13% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Volume Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Metal Type Segment | Lithium, Nickel, Cobalt, Manganese, Aluminum, Others |

| Battery Type Segment | Lithium-ion (Li-ion) Battery, Nickel-metal Hydride Battery, Others |

| Application | Personal Vehicles, Commercial Vehicles |

| Geographies | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

| Countries | US, Canada, Germany, UK, Italy, Spain, Rest of Europe, China, Japan, India, Korea, Rest of Asia Pacific, Brazil, Rest of Central & South America, GCC, South Africa, Rest of Middle East & Africa |

| Key Companies | Glencore International AG, Sociedad Quimica y Minera de Chile (SQM), Albemarle Corporation, Ganfeng Lithium Co. Ltd., AngloAmerican PLC, Tianqi Lithium Corp., Vale S.A., China Molybdenum Co., Ltd., Eurasian Resources Group, Norilsk Nickel, Eramet, and Freeport-McMoRan |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

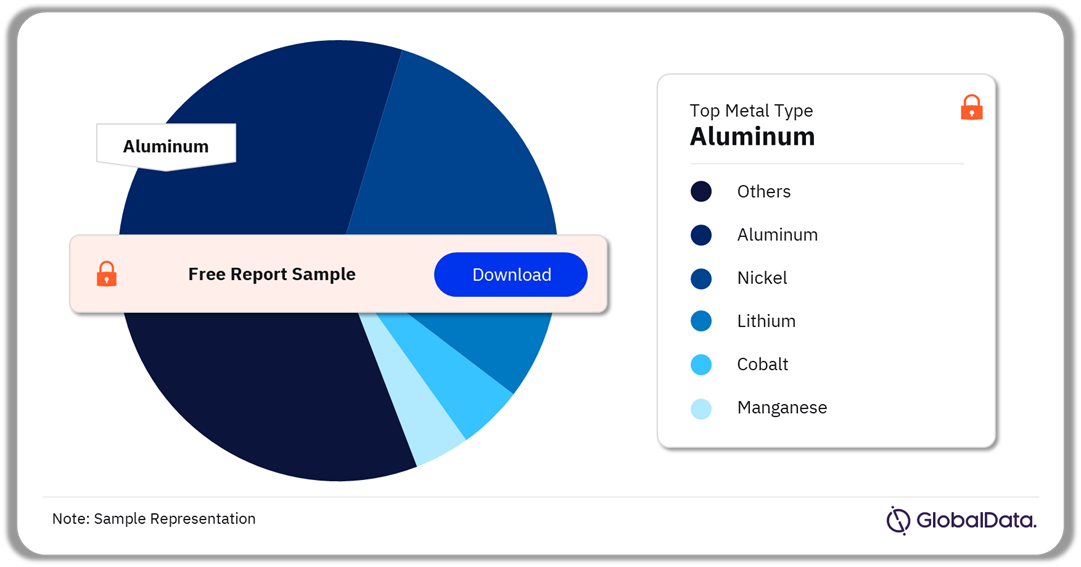

Metals in EV Battery Market Segmentation by Metal Type

Aluminum metal led the market in 2023 in terms of metal type with the highest share of approximately 28%. The high use of aluminum in the typical composition of cathode across battery chemistries contributes to its dominating share across the market. The utilization of aluminum as a structural support component in the battery module or pack contributes to weight reduction and improved energy efficiency. The demand for these characteristics in advanced battery technology is driving the growth of this segment.

Metals in EV Battery Market Share by Metal Type, 2023 (%)

Buy the Full Report for More Information on Metals in the EV Battery Market Metal Type

Nickel held the second-largest share in the EV batteries market in 2023. The sizable share of nickel in the EV battery market, globally, is supported by the presence of diverse nickel-based battery types, including nickel-metal hydride (Ni-MH), nickel cobalt-aluminum (NCA), and nickel-manganese-cobalt (NMC) batteries. The segment is further projected to witness considerable growth with the development and adoption of new and advantageous technologies that use nickel. To address this, Tesla agreed with LG Chem to utilize their new NCMA (nickel, cobalt, manganese, and aluminum) battery cells for EVs. This cathode material is utilized in Model Y.

Lithium is one of the most important metals in the EV batteries market, as this metal plays a crucial role in lithium-ion batteries that dominate the overall market. The increasing adoption of EVs in the global passenger car market is a key driver for lithium demand. Consequently, vehicle manufacturers and lithium suppliers are strategizing investments to expand production capacities and meet the rising demand. For instance, in April 2024, Lithium Americas announced an underwritten public offering to raise $275m, earmarked for the construction and development of the Thacker Pass lithium project in Humboldt County, Nevada.

Metals in EV Battery Market Segmentation by Battery Type

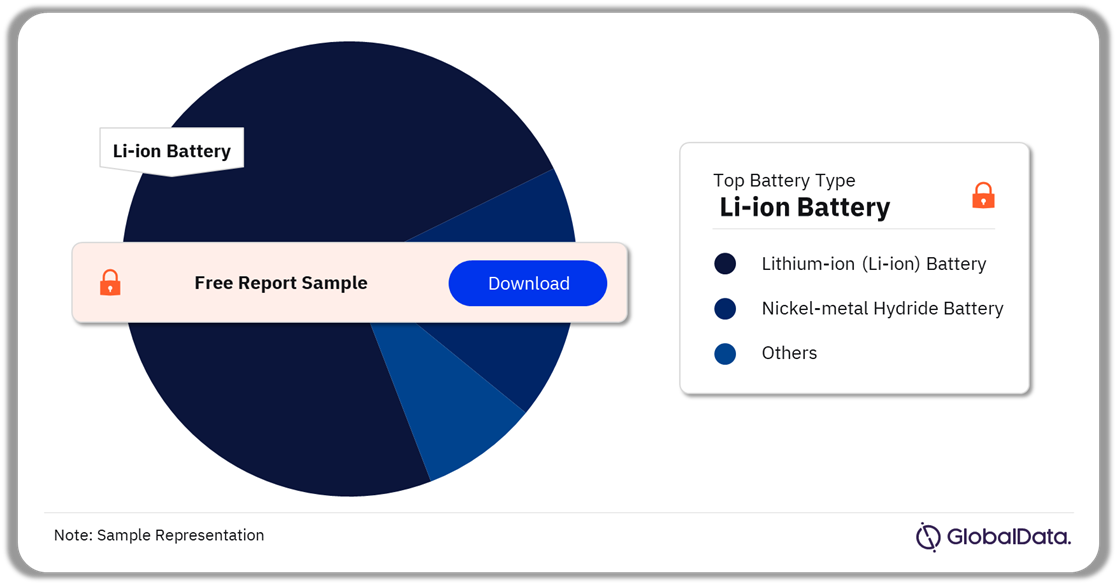

Lithium-ion battery type dominated the overall market with the maximum volume share in 2023 due to their extensive use in electric vehicle batteries. Lithium’s lightweight nature and superior charge-holding capabilities compared to heavier alternatives such as lead, zinc, and nickel-cadmium, support its dominance globally. China leads the global lithium-ion battery production, with most manufacturing processes concentrated within the country. China has also secured significant rights for future production to further strengthen its position in the global EV battery market.

Metals in EV Battery Market Share by Battery Type, 2023 (%)

Buy the Full Report for More Information on Metals in the EV Battery Market Battery Type

In 2023, the nickel-metal hydride (NiMH) battery segment held the second position in terms of volume, following lithium-ion batteries. NiMH batteries have found application in EVs primarily because of their notable strength and durability. Moreover, NiMH batteries can deliver high power outputs, facilitating swift acceleration and ensuring overall impressive performance in EVs.

The other category, which includes solid-state batteries, sodium-ion batteries, aluminum-ion GNG batteries, lithium-sulfur batteries, Li-Po batteries, and lithiated manganese dioxide (LMD) batteries, is projected to witness the fastest growth with a CAGR of more than 17% over the forecast period. Some of these battery types, such as sodium-ion batteries and lithium-sulfur batteries, are still in the emerging phase. The continuous development and adoption of these emerging battery technologies will help drive market expansion in the coming years.

Metals in EV Battery Market Segmentation by Application

In 2023, the personal vehicles segment led the market with a higher volume share than commercial vehicles. The segment is expected to grow with the rising demand for electric vehicles for personal use due to the long-term advantages they offer to consumers. In addition to this, rising environmental consciousness among consumers, government subsidies on purchasing EV vehicles, and cost savings on fuel and maintenance will further boost growth in this segment.

Metals in EV Battery Market Share by Application, 2023 (%)

Buy the Full Report for More Information on Metals in the EV Battery Market Application

The commercial vehicles segment is anticipated to exhibit the fastest growth over the forecast period due to the rising demand for electric commercial vehicles in the transportation sector. The growth is supported by the developments incorporating advanced electric battery technology, capable of meeting the demanding requirements of heavy-duty applications and extended driving hours. In January 2024, Vicinity Motor Corp. signs a VMC 1200 distribution agreement for Peninsula VMC Truck Centre in South Toronto, Canada. Peninsula VMC Truck Centre will distribute Vicinity trucks in Brantford, Burlington, Hamilton, and Niagara as per the agreement terms.

Some of the noticeable examples of commercial electric vehicles include semi-truck and delivery vans by Tesla; electric pickup trucks and delivery vans by Rivian; electric buses, trucks, and vans by BYD; electric buses and transit vehicles by Proterra; electric commercial vans and pickup trucks by Ford; and electric commercial vans and trucks by General Motors.

Metals in EV Battery Market Analysis by Region

In 2023, Asia Pacific led the market with a maximum volume share of more than 55%, with China emerging as the leading contributor within the region. India is projected to record the fastest growth at a CAGR of around 32% over the forecast period. This surge can be attributed to the increasing investments in the mining sector. The growth is further bolstered by the growing interest of global companies in the Indian market, which presents several opportunities for EV battery production.

Metals in EV Battery Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Metals in the EV Battery Market

Europe held the second-largest share in metals in the EV battery market. This can be attributed to the region’s robust support and regulations in the sustainable transportation sector, which have fostered the adoption of electric vehicles and stimulated the demand for EV batteries. Germany leads the regional market with a maximum volume share in 2023. The country is in the developing phase of a highly efficient battery metal recycling industry, which is expected to support the sustainable production of battery metals over the forecast period.

Central & South America is projected to witness the fastest growth with a CAGR of over 40% during the estimated timeframe. Brazil currently holds the leading position in the regional market, while the other countries contributing to the noticeable growth of the region include Argentina, Chile, Paraguay, and Uruguay. These countries are expanding their mining and exploration capacities to meet the increasing demand from the global application industry by exporting necessary raw materials for battery production, in addition to catering to the regional market.

Metals in EV Battery Market – Competitive Landscape

The market is largely characterized by major players with a global presence, as the exploration and mining of necessary metals is a cost-intensive process, which requires advanced infrastructure for efficient operations. Hence, the market is largely defined by international players with strong global networks, who fulfill the demand for metals used in EV battery manufacturing worldwide.

New partnerships and collaborations play a crucial role in the strategies of companies involved in metals mining and EV component manufacturing, as they seek to enhance their market reach and profitability on a global scale. For example, in April 2024, European Lithium Limited reached an agreement to acquire LRH Resources Limited, a subsidiary of Technology Metals plc (TM1), with TM1 agreeing to sell 100% of LRH Resources Limited’s issued share capital.

Leading Companies in the Metals in EV Battery Market

- Glencore International AG

- Sociedad Quimica y Minera de Chile (SQM)

- Albemarle Corporation

- Ganfeng Lithium Co. Ltd.

- AngloAmerican PLC

- Tianqi Lithium Corp.

- Vale S.A.

- China Molybdenum Co., Ltd.

- Eurasian Resources Group

- Norilsk Nickel

- Eramet

- Freeport-McMoRan

Other Metals in EV Battery Market Vendors Mentioned

Global Cobalt, Nornickel, Lithium Americas, LG Chem, Sigma Lithium, Arcadium Lithium, and Piedmont Lithium.

Buy the Full Report to Know More About Leading Metals in EV Battery Companies

Metals in EV Battery Market Segments

GlobalData Plc has segmented the Metals in the EV Battery market report by metal type, battery type, application, and region:

Metals in EV Battery Market Metal Type Outlook (Volume, Million Tonnes, 2020–2030)

- Lithium

- Nickel

- Cobalt

- Manganese

- Aluminum

- Others

Metals in EV Battery Market Battery Type Outlook (Volume, Million Tonnes, 2020–2030)

- Lithium-ion (Li-ion) Battery

- Nickel-metal Hydride Battery

- Others

Metals in EV Battery Market Application Outlook (Volume, Million Tonnes, 2020–2030)

- Personal Vehicles

- Commercial Vehicles

Metals in EV Battery Market Regional Outlook (Volume, Million Tonnes, 2020–2030)

- North America

- US

- Canada

- Europe

- Germany

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Korea

- Rest of Asia Pacific

- Central & South America

- Brazil

- Rest of Central & South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Scope

The market intelligence report provides an in-depth analysis of the following –

• Metals in EV battery market outlook: analysis as well as historical figures and forecasts of volume opportunities from the metal type, battery type, application, and regional segments.

• The competitive landscape: an examination of the positioning of leading players in the metals in EV battery market.

• Company Analysis: analysis of the market position of leading service providers in the metals in EV battery market.

• Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

The metals in EV battery market size was estimated at 3.9 million tonnes in terms of volume in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.4% over the forecast period. The metals in EV battery market report provides an executive-level overview of the current market worldwide, with detailed forecasts of key indicators up to 2030.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global metals in EV battery market by metal type, battery type, application, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in metals in EV battery markets.

• With more than 120 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in metals in EV battery markets.

• The broad perspective of the report coupled with comprehensive, actionable detail will help mining sector stakeholders, service providers, and other metals in EV battery players succeed in growing the metals in EV battery market globally.

Sociedad Quimica y Minera de Chile (SQM)

Albemarle Corp.

Ganfeng Lithium Group Co. Ltd.

Anglo American PLC

Tianqi Lithium Corp.

Vale S.A.

CMOC Group Ltd.

Eurasian Resources Group

MMC Norilsk Nickel

Eramet SA

Freeport-McMoRan

Table of Contents

Table

Figures

Frequently asked questions

-

What was the metals in the EV battery market size in 2023?

The metals in EV battery market size was estimated at 3.9 million tonnes in 2023.

-

What is the metals in the EV battery market growth rate?

The metals in the EV battery market is expected to grow at a CAGR of more than 13% during the forecast period.

-

What is the key metals in the EV battery market driver?

The metals in the EV battery market is primarily driven by the rising focus of consumers toward sustainable alternatives to traditional combustion engine-based vehicles.

-

Which was the leading metal type in the metals in the EV battery market in 2023?

The aluminum segment accounted for the largest share of metals in the EV battery market in 2023.

-

Which are the leading metals in EV battery companies globally?

The leading companies in the metals in EV battery market are Glencore International AG, Sociedad Quimica y Minera de Chile (SQM), Albemarle Corporation, Ganfeng Lithium Co. Ltd., AngloAmerican PLC, Tianqi Lithium Corp., Vale S.A., China Molybdenum Co., Ltd., Eurasian Resources Group, Norilsk Nickel, Eramet, and Freeport-McMoRan.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Mining reports